What’s new in banking app features 2025

Mobile banking apps in 2025 will feature enhanced security measures, user-friendly navigation, interactive elements, and responsive designs to provide a safer and more engaging banking experience.

What’s new in banking app features 2025 is an exciting topic that reveals how the industry is evolving. As tech advances, banking apps are becoming more user-friendly and feature-rich, reshaping the way we manage our finances. Have you wondered what game-changing features may soon be at your fingertips?

Trends shaping banking app development

The world of banking apps is constantly evolving. In 2025, several trends are set to shape the way we interact with our finances. Understanding these trends can help users navigate their banking experience more efficiently.

Personalization and Customization

One major trend is the rise of personalization features. Banking apps are now tailored to meet individual users’ needs. From transaction alerts to personalized recommendations, these features enhance user engagement.

- Customized spending insights

- Personal financial goals tracking

- Tailored product recommendations

Artificial Intelligence Integration

Artificial Intelligence is transforming banking apps. AI helps in fraud detection, automates customer service via chatbots, and improves user support. These advancements not only enhance security but also streamline user experience.

As users become more tech-savvy, they expect more intuitive interfaces. The integration of AI allows for a seamless interaction, making tasks easier and quicker.

Enhanced Security Measures

With increasing concerns over online security, apps are prioritizing robust security features. Biometric authentication, such as facial recognition and fingerprint scanning, is becoming commonplace. These tools not only improve security but build user trust.

- Multi-factor authentication systems

- Real-time transaction notifications

- Automatic fraud alerts

Additionally, user education on security practices is essential. Banking apps may include tips to help users protect their financial information.

The trends shaping banking app development reflect a commitment to providing users with better tools and enhanced security. As we look to the future, it’s clear that user satisfaction will remain a key focus for developers.

Key features to expect in 2025

As we look towards 2025, several key features are expected to revolutionize banking apps. These features will enhance user experience, convenience, and security, making banking more accessible than ever.

Seamless Integration with Other Services

One anticipated feature is seamless integration with third-party services. Banking apps will allow users to link their accounts to budgeting tools, investment platforms, and payment services without hassle. This connectivity helps users manage finances more easily.

- Linking to accounting software

- Access to personal finance apps

- Integration with e-commerce platforms

Voice Banking

Voice banking is gaining traction, thanks to advances in voice recognition technology. Users will be able to perform transactions, check balances, and get account information simply by speaking. This hands-free feature is convenient, especially for those on the go.

As more people adapt to smart home devices, the demand for voice-activated banking will rise, making it an integral part of the user experience.

Real-Time Tracking and Notifications

In 2025, expect enhanced real-time tracking and notification systems. Users will receive instant alerts for spending, transactions, and even bill due dates. These notifications empower users to stay on top of their finances and prevent unnecessary fees.

- Customizable spending alerts

- Real-time transaction monitoring

- Notifications for budget limits

Overall, these features aim to create a more interactive experience, allowing users to make informed decisions effortlessly.

User-friendly design will also play a crucial role. Enhanced user interfaces will make navigation intuitive, enabling users of all ages to take advantage of new features without confusion or difficulty.

Security enhancements in mobile banking

Security enhancements in mobile banking are crucial as digital transactions become more common. In 2025, banks are expected to implement various innovative security features to protect users’ sensitive information.

Biometric Authentication

One major advancement is the use of biometric authentication. This technology allows users to access their accounts using fingerprints or facial recognition. These methods provide a high level of security, ensuring that only the account holder can access their banking information.

- Fingerprint scanning for secure logins

- Facial recognition for quick access

- Voice recognition as an added layer

Enhanced Encryption Techniques

Another key feature is enhanced encryption techniques. Banks are now employing advanced encryption methods to protect data transmitted between devices. This means that even if data is intercepted, it remains unreadable.

Real-time encryption protects transactions, making it more difficult for hackers to access sensitive financial information. As technology progresses, these security measures will continue to evolve.

Two-Factor Authentication (2FA)

Two-Factor Authentication (2FA) is becoming a standard practice in mobile banking. This process requires users to provide two different forms of verification before accessing their accounts. It adds an extra layer of security, reducing the risk of unauthorized access.

- SMS or email verification codes

- Authentication apps for secure access

- Push notifications for transaction approvals

In addition, banks are investing in user education. Providing tips and resources helps customers learn how to protect their accounts. This proactive approach ensures users are aware of potential threats and the steps they can take to mitigate them.

User interface innovations for better engagement

User interface innovations are essential for boosting engagement in mobile banking apps. In 2025, these advancements will focus on enhancing user experience and making banking more accessible and enjoyable.

Simplified Navigation

One of the key innovations will be simplified navigation. Apps will feature more intuitive layouts that allow users to find what they need quickly. This improvement helps users, especially those who may not be tech-savvy, feel more confident when using the app.

- Clear icons for easy understanding

- Search functions to locate features quickly

- Personalized dashboards to highlight important sections

Interactive Elements

Interactive elements are becoming a standard in app design. Features like chatbots for customer service, interactive tutorials, and feedback options enable users to engage actively with the app. This level of interaction keeps users invested and informs them about new functionalities.

Gamification strategies, such as rewards for completing tasks or achieving savings goals, also enhance user experience. These features make banking feel less routine and more engaging.

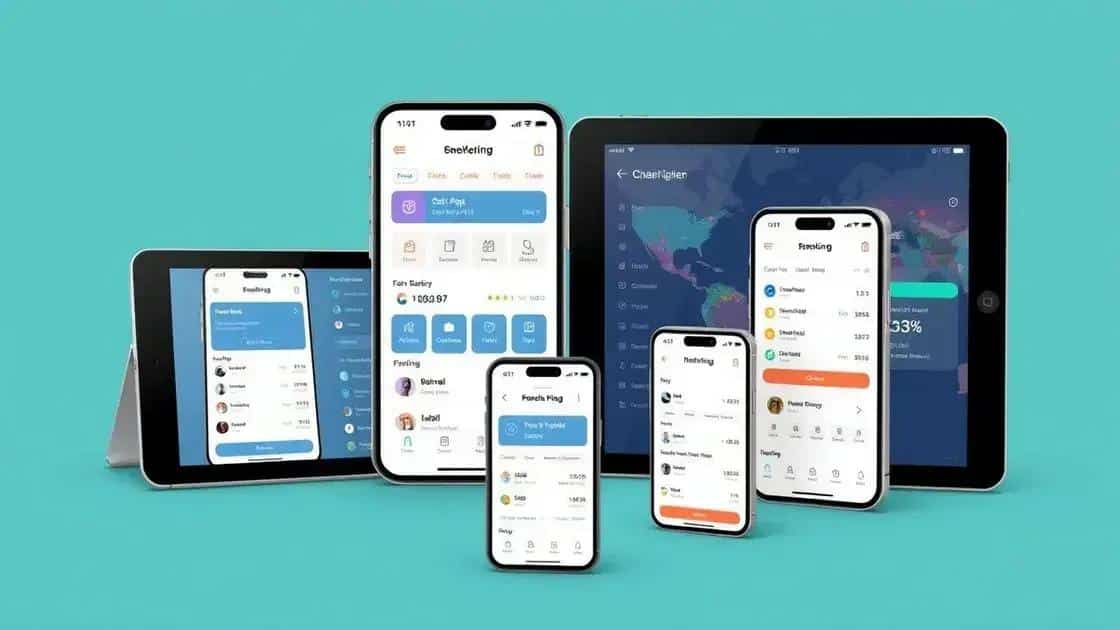

Responsive Design

Responsive design is critical for mobile banking apps. As users access their banking information on various devices, ensuring a consistent experience across platforms is vital. Apps will adapt to different screen sizes and orientations, providing the best experience no matter the device.

- Flexible layouts for phones and tablets

- Easy adjustments for landscape and portrait views

- Consistent branding and functionality

By integrating these user interface innovations, banking apps will create a more engaging and pleasant experience. The focus on the user’s journey from beginning to end is vital for retaining customers and building loyalty in an increasingly competitive market.

FAQ – Frequently Asked Questions about Mobile Banking Innovations

What are the main security features in mobile banking apps?

Mobile banking apps use biometric authentication, encryption, and two-factor authentication to enhance security and protect user data.

How does a simplified navigation improve user experience?

Simplified navigation allows users to find features quickly, making the app more user-friendly, especially for those who may not be tech-savvy.

What role does gamification play in banking apps?

Gamification engages users by providing rewards for completing tasks, making banking more interactive and enjoyable.

Why is responsive design important for banking apps?

Responsive design ensures that the app functions well on various devices, providing a consistent experience regardless of screen size.